Scale (by Geoffrey West) - Part 27

The wealth of a nation these days is mostly obtained via the wealth of organizations residing in it:

The USA has 30 million registered companies - but only around 4,000 are publicly traded:

The central question is: Are there universal scaling laws governing companies (as they do biological organisms, cities):

We have a kind of capitalistic system going on now - but we have both pluses and minuses:

Traditional principles seen to drive modern organizations:

The Renaissance Tech people had an interest in these sorts of mega-scale analyses:

Axtel is an expert in agent-based modeling:

Looking into more and more details is not helping us to predict how complex systems are going to behave:

Obligatory Taleb mention:

Agent-based simulations are quite different from traditional scientific approaches - where compression is a major goal:

In complex systems, we can find a few “root factors” which explain 70-80% of the behavior; these can be explained via universal-like laws. But then the rest of the 20-30% of the behaviors are “individualistic” or “idiosyncratic” and requires a more simulation like approach to approximate:

S&P charges 50k USD for its full dataset:

Finally, NSF paid that up for these academics, but not without effort:

The “market phenomenon” in the way it exists is a novel phenomenon - maybe a couple of hundreds year old:

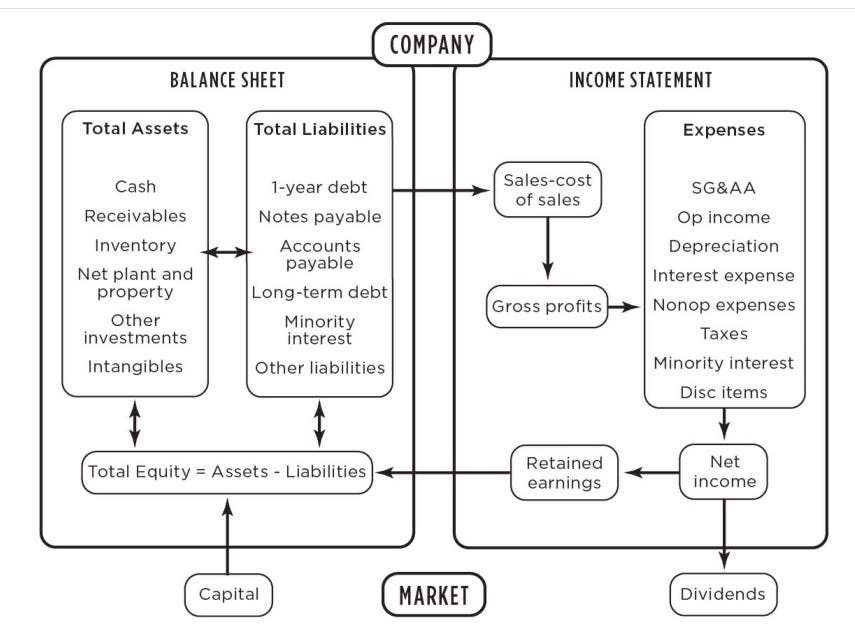

A diagram of how the market and the company are connected:

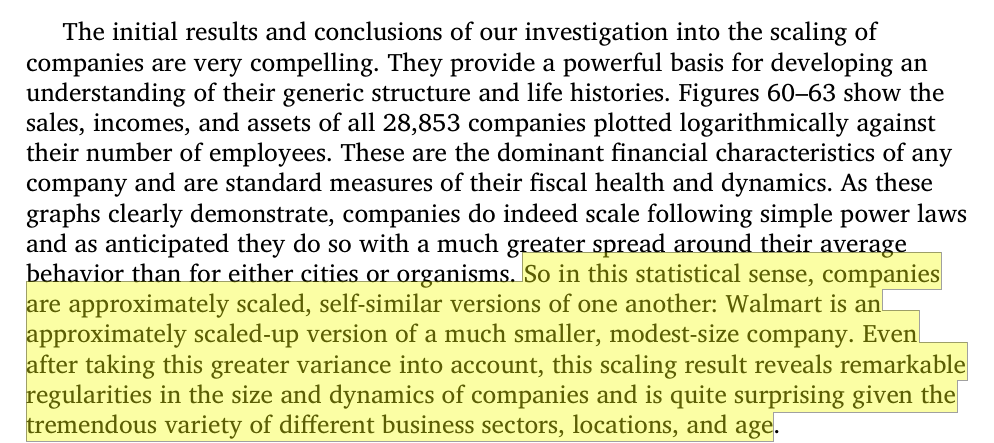

Companies follow scaling power laws like cities and biological organisms:

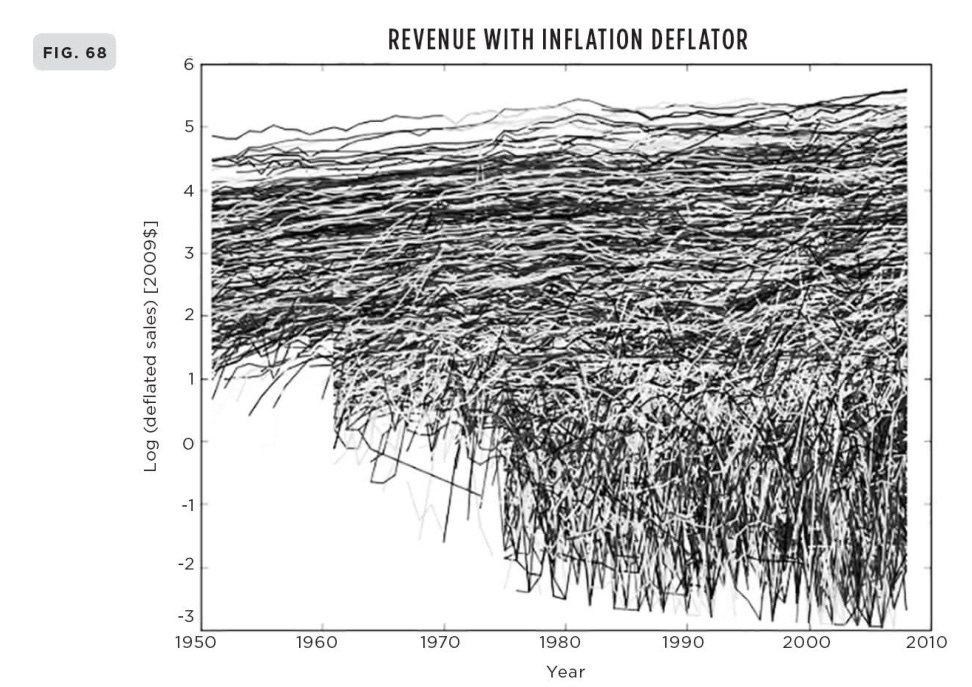

This is how the graphs look for the case of companies:

Axtell used the binning procedure to establish sublinear scaling for various company dimensions - although the procedure itself is more data-sciencey rather than pure sciencey:

Similar trends have been observed in the data for chinese companies:

Companies scale sub linearly in most metrics rather than super linearly; that is - they are more like organisms rather than cities. That means - they eventually die.

Companies die - but another curious thing to look at is - how various “empires” of the past have fared. In China and India and Rome and Greece - we’ve had empires of all sorts - it’d be interesting to understand their lifetimes. Do they on average tend to live longer than companies? Clearly - they are not as resilient as cities.

The study of profits is very important to understand company survival:

Revenue is like food, part of which goes to “maintenance” and the rest goes to "growth”.

The metabolic rate of companies tends to be linear - generally sitting between organisms and cities:

A company must keep up with the market’s expansion rate to survive itself:

Companies grow rapidly early on and later slow down a bit:

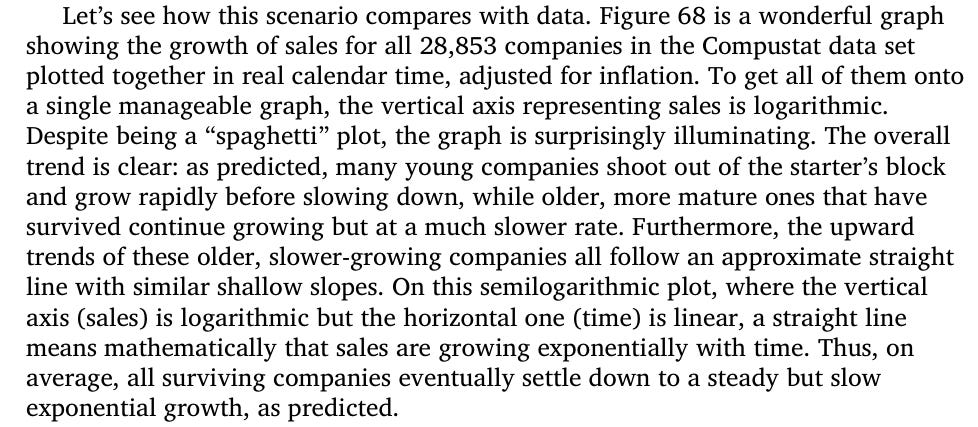

All surviving companies settle into a slow but exponential growth:

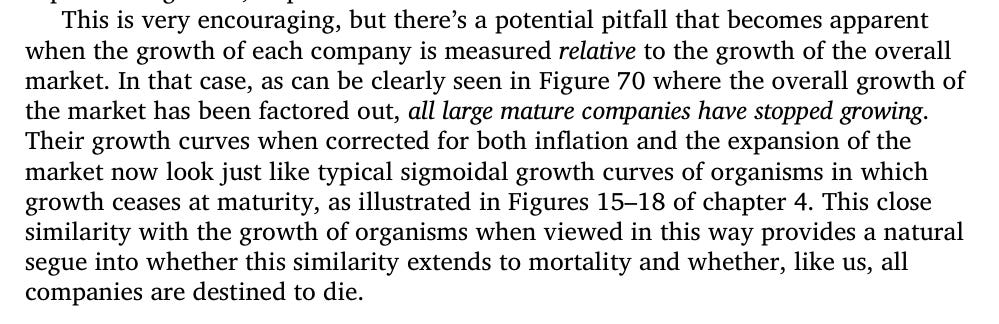

At some point - the market growth is more than the company can keep up with; at this point the company practically stops growing; it’s just going with the flow, the past momentum, and the waves in the sea. It is not really propelling itself anymore:

It's interesting how you connect these ideas That line about 'a few “root factors” which explain 70-80% of the behavior' versus the 'individualistic' 20-30% really struck a chord. It makes so much sense for complex systems something I often consider when teaching algorithms. Such an insightful way to frame predictive modeling.